Retailers Point to Unfavorable Weather Impacts in Q1 Results

A slowing economy, a more cautious customer, and post-pandemic spending shifts were all concerns raised by retailers in the last couple of weeks as earnings were released. These trends have hurt some retailers more than others and another key element of uncertainty and sales volatility – the weather – played into disappointing Q1 results for those chains heavily dependent on seasonal sales.

“As the weather turns warm and sunnier, it can inspire shoppers to buy summer dresses, beach towels or gardening supplies,” CNBC wrote in a recent report. “Sam’s Club has noticed slower sales of patio sets, perhaps because of the later-to-hit spring weather… Walmart has seen a sharp drop in air conditioner sales at its big-box stores.”

Shoe Carnival noted the impact in its Q1 earnings press release reporting that the weather “impacted net sales, with spring seasonal product down approximately 23 percent compared to first quarter 2022.”

“We saw materially softer demand in our seasonal products due to a delay in the spring selling season across most of our markets, notably in the last few weeks of March,” said the president and chief executive officer of Tractor Supply (Source: Hardware Retailing).

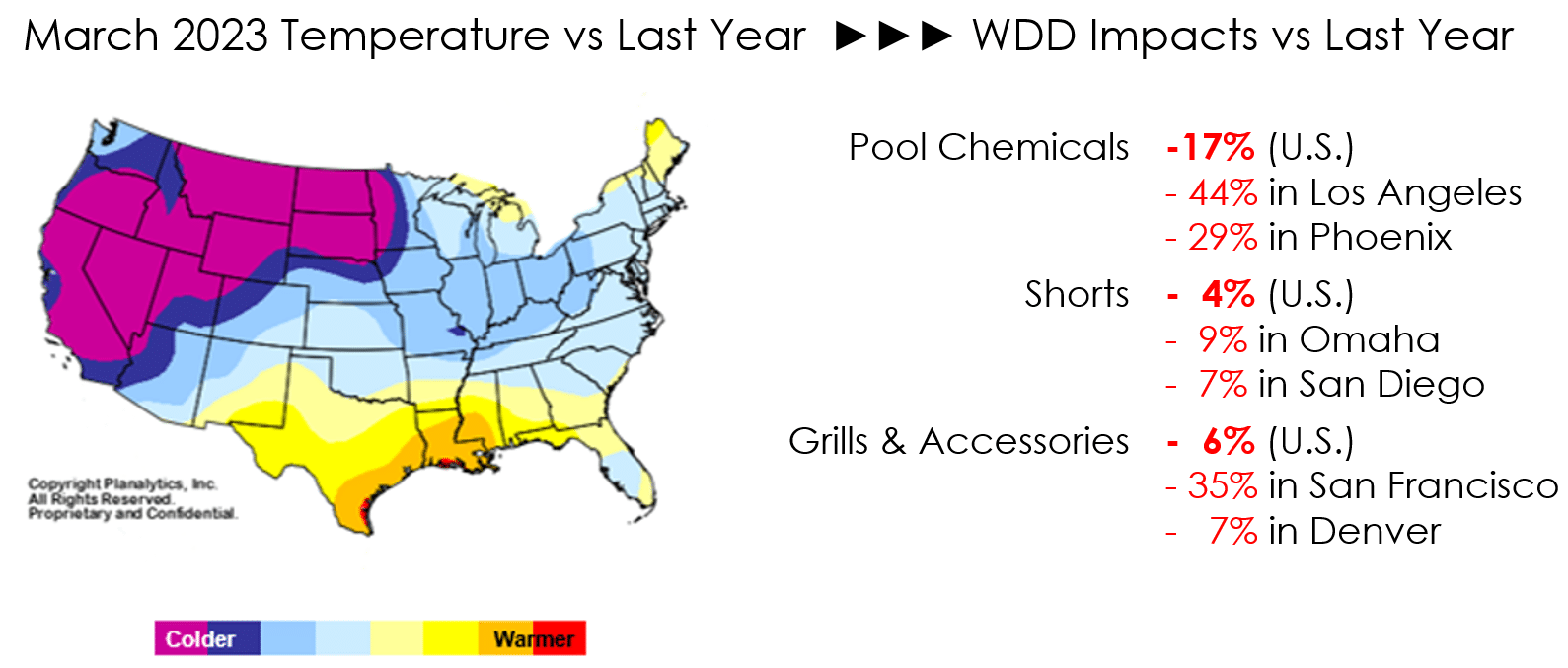

It is true that, in general, the weather did no favors for clothing retailers and DIY chains during the critically important early spring period. For the U.S. overall, this March was the coolest in ten years, delaying the start of the spring selling season in many western and northern markets (see graphic). Planalytics quantifies the business impacts of the weather with a metric called WDD (Weather-Driven Demand). Many spring product WDDs confirmed the challenging environment retailers faced in March.

WDD calculations measuring the impact on overall transactions were negative compared to last March for the DIY/Home Center, Apparel, and QSR/Restaurant sectors. For example, DIY transactions saw a weather impact of -11% in Boise and -7% in Albany; Apparel transactions were -6% in Buffalo and -4% in New York City due to the weather; QSR receipts were -9% in Sacramento and -2% in Indianapolis on less favorable conditions.

As always, the weather and its sales impacts are continually shifting presenting both risks and opportunities and a market-by-market basis. As the Chairman, CEO & President of The Home Depot said on their Q1 earnings call (Source: The Motley Fool) “where weather was favorable, we saw strength in key spring-related categories such as live goods and other garden-related categories.”

The “weather” is going to happen, but retailers leveraging Weather-Driven Demand analytics have valuable visibility into the sales impacts. How changes in the weather affect performance does not have to be a surprise and retailers can use predictive WDD analytics to proactively manage this critical external purchasing influencer. Contact us to discuss how your business can benefit.

More favorable weather arrived in April in northeastern markets although California and the southwest were challenged by cooler conditions. And, for the first month (May) of most retailers’ Q2, cooler year-over-year temperatures in the East, and chillier and wetter conditions compared to 2022 in the Southwest suggest difficult weather headwinds remained a challenge for many retailers.