NRF Discusses Holiday Retail Sales Outlook

On November 6th, the National Retail Federation (NRF) held a webinar focused on retail sales expectations during the 2023 holiday shopping season. NRF Chief Economist Jack Kleinhenz and Vice President, Industry and Consumer Insights Katherine Cullen hosted the presentation (view the webinar recording) which discusses the NRF’s 2023 holiday sales forecast, economic considerations, and consumer spending insights.

NRF forecasts that total retail sales during the holiday months of November and December will grow between 3% and 4% over 2022 to between $957.3 billion and $966.6 billion.

Earlier this month, NRF President and CEO Matthew Shay said, “Overall household finances remain in good shape and will continue to support the consumer’s ability to spend.” And the NRF notes on their Winter Holidays webpage that “despite a slower growth rate compared with the past three years, when trillions of dollars of stimulus led to unprecedented rates of retail spending during the pandemic, this year’s holiday spending is consistent with the average annual holiday increase of 3.6% from 2010 to 2019.”

Jack Kleinhenz kicked off the webinar with an overview of the NRF’s holiday forecast. “Broadly speaking, the consumer is generally in a good place and has been for some time,” he said. “And their purchasing capabilities remain in place. They’ve been resilient especially navigating around headwinds of inflation, higher interest rates, tighter credit… all these factors are going to be influencing as we go forward into the fourth quarter and will probably have an impact on the pace, and slower pace, of spending.”

He went on to summarize key elements of the forecast covering the economy, the consumer, the employment picture, prices/inflation, along with additional factors that can have an impact.

Citing an outlook from the U.S. Energy Information Administration, Kleinhenz noted that “we might get some benefit from lower heating costs.” He also noted a headwind due to changing consumer priorities as “there has been a continuing shift of spending from goods to services.”

“And, of course, weather often is an important ingredient in the outlook and it can change how people decide to shop or other activities they want to do.”

Weather-driven demand analytics are a valuable tool retailers can use to proactively manage the weather’s impacts on traffic and category sales. Learn more by reviewing 5 Myths About the Weather and Its Impact on Retail, a joint report published by Planalytics and the NRF.

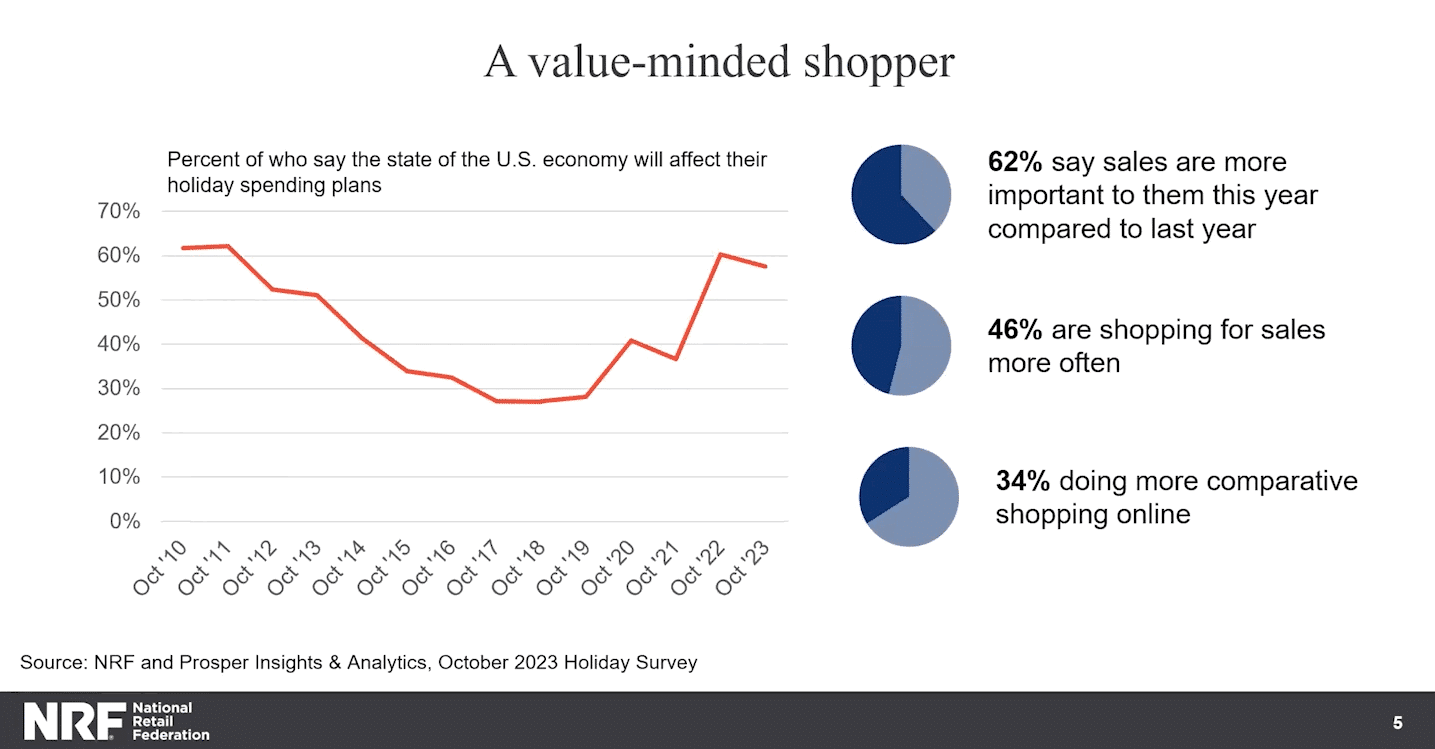

Katherine Cullen shared consumer sentiment data from some of the NRF’s surveys and how shoppers are “refocusing their budget” with an emphasis on essentials, experiences and non-essential services, and special events including holidays.

“We are seeing a shift in how people approach the holidays” and, Cullen highlighted that this is evident in the emergence of more value-minded shoppers who say “the state of the economy is going to impact their spending plans and, in particular, they’re more focused on sales. They want to feel that they are finding value this season and making every dollar count.”

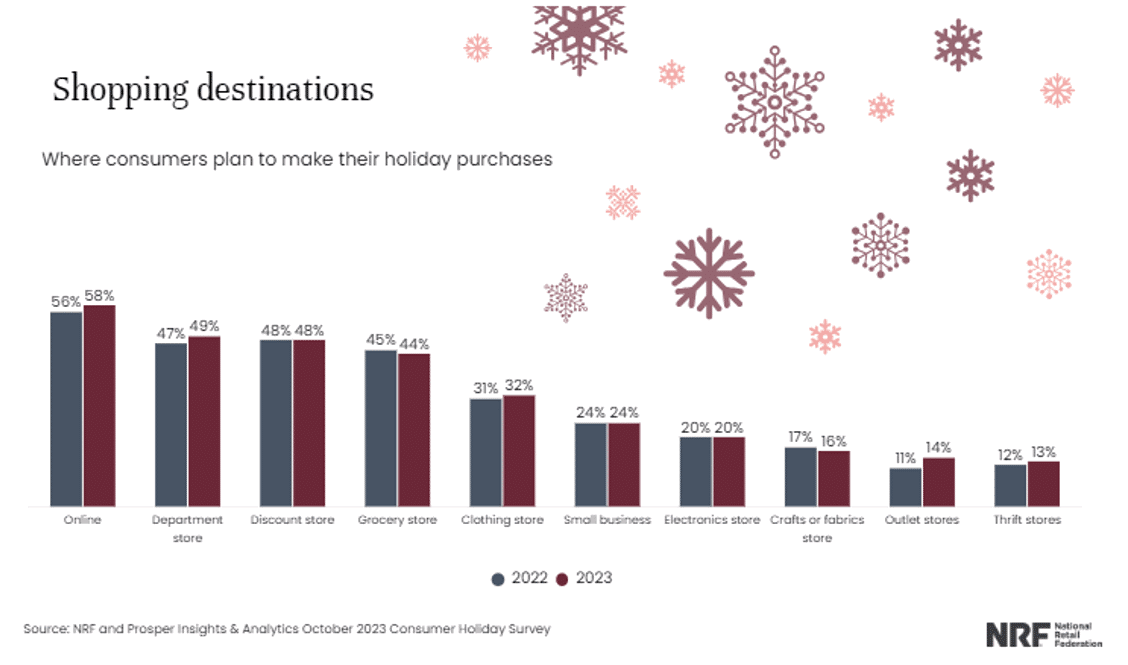

Cullen concluded the presentation with high-level insights into merchandise categories that are expected to be in greater or reduced demand and trends on where – or the channels – people plan to use this season.