Markdowns Rise & Margins Fall

WWD published an article (Q3 Markdowns Rising, Margins Falling – 8/30/22; subscription required) highlighting how several retailers are facing significant pressure on margins due to high inventories.

“It’s markdown city,” said Dana Telsey, chief executive officer and chief research officer of the Telsey Advisory Group. “Deals are all around. Everyone’s inventory levels are high. There was an acceleration of promotions in the second quarter, and it will stay at the same rate and could get even more aggressive in the third quarter.” … The retail landscape is awash in markdowns that continue to build — and that will take a sharp toll on third-quarter profits and margins, especially at apparel specialty chains and department stores catering to low- and middle-income families. Spending is shifting more to essentials and away from nonessentials. [Excerpt from WWD]

Overplanning certainly played a big part with some retailers over-correcting for supply chain challenges that had led to empty shelves and lost sales.

Another reason stores are over-inventoried and forced to offer deep markdowns comes from an eternal external variable that shifts – often quite significantly – the year-over-year demand trends for certain products: THE WEATHER. As you will see below, the unfavorable weather in Q2 directly contributed to the backup in inventory that forced many retailers to take aggressive markdowns.

You can mark this down. Retailers preserve margin with predictive demand analytics is an article in Retail Dive that looked at three ways to limit markdowns with weather-driven demand analytics. The first approach discusses how improved planning accuracy ahead of the season can reduce the need for markdowns as a selling season winds down.

Pre-season planning & allocation.

When retailers plan the next season or year they must correct the weather bias embedded in past sales performance. This “deweatherization” process improves accuracy by accounting for when favorable weather conditions exaggerated sales or unfavorable conditions deflated sales. In situations where prior sales are inflated, the positive weather environment rarely materializes to the same degree again the next year. The result: retailers often end up with excess inventories that need to be marked down to clear stocks. So instead of unintentionally chasing weather-biased sales from the prior year, which are statistically unlikely to repeat, retailers can use weather-driven demand to improve plan accuracy and adjust inventories on a market-by-market basis. [Excerpt from Retail Dive]

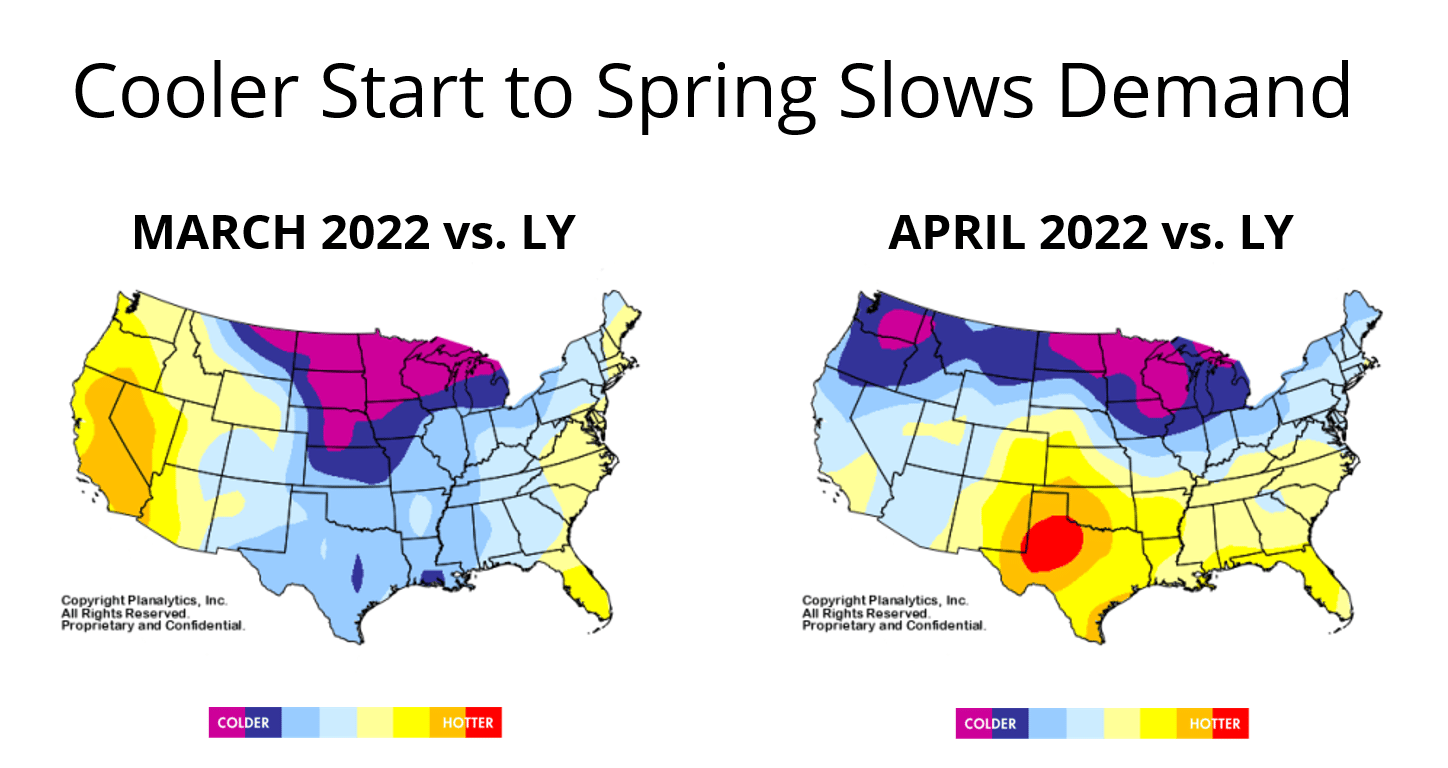

Planalytics helps retailers use weather-driven demand analytics to “deweatherize” sales histories and remove planning/forecasting error. For a great example of why this process helps improve plans, and ultimately, margins, look no further than March & April 2022 versus prior year. Together these two critical months provided a much more unfavorable early season demand environment in many key U.S. regions and markets.

The negative weather comp extracted $864 million in sales from the Specialty Apparel sector alone during these two early spring months versus 2021. The Home Center/DIY sector fared even worse, with a negative year-over-year weather-driven sales impact of $1.9 billion.

Visit Planalytics to learn more about how predictive weather-driven demand analytics can help retailers more optimally align inventories with consumer purchasing and improve sales, lower costs, and enhance profitability.