Going Green: Sustainability Gains Can Boost Bottom Lines

In a three-part series, Grocery Dive explored how supermarkets can increase profitability while pursuing sustainability initiatives.

“As sustainability work becomes more prominent across the grocery industry, food retailers are faced with the questions of if, how and when to have their eco-friendly measures tie back to their bottom line. In this three-part series, Grocery Dive explores how sustainability initiatives connect to grocers’ financial planning and reporting.”

In the first article, Grocery Dive looks at how grocers are finding they are pleasing shoppers by addressing sustainability but how it remains more challenging to win over investors.

“Top managers of other publicly traded food retailers that also highlight their sustainability programs… don’t often field questions during earnings calls about their Environmental, Social and Governance (ESG) initiatives, even as metrics like same-store sales and earnings per share are top topics of discussion. That disconnect stems from the fact that while paying attention to the planet might be laudable, demonstrating the connection between sustainability and the bottom line remains a substantial challenge for the supermarket industry, according to analysts.”

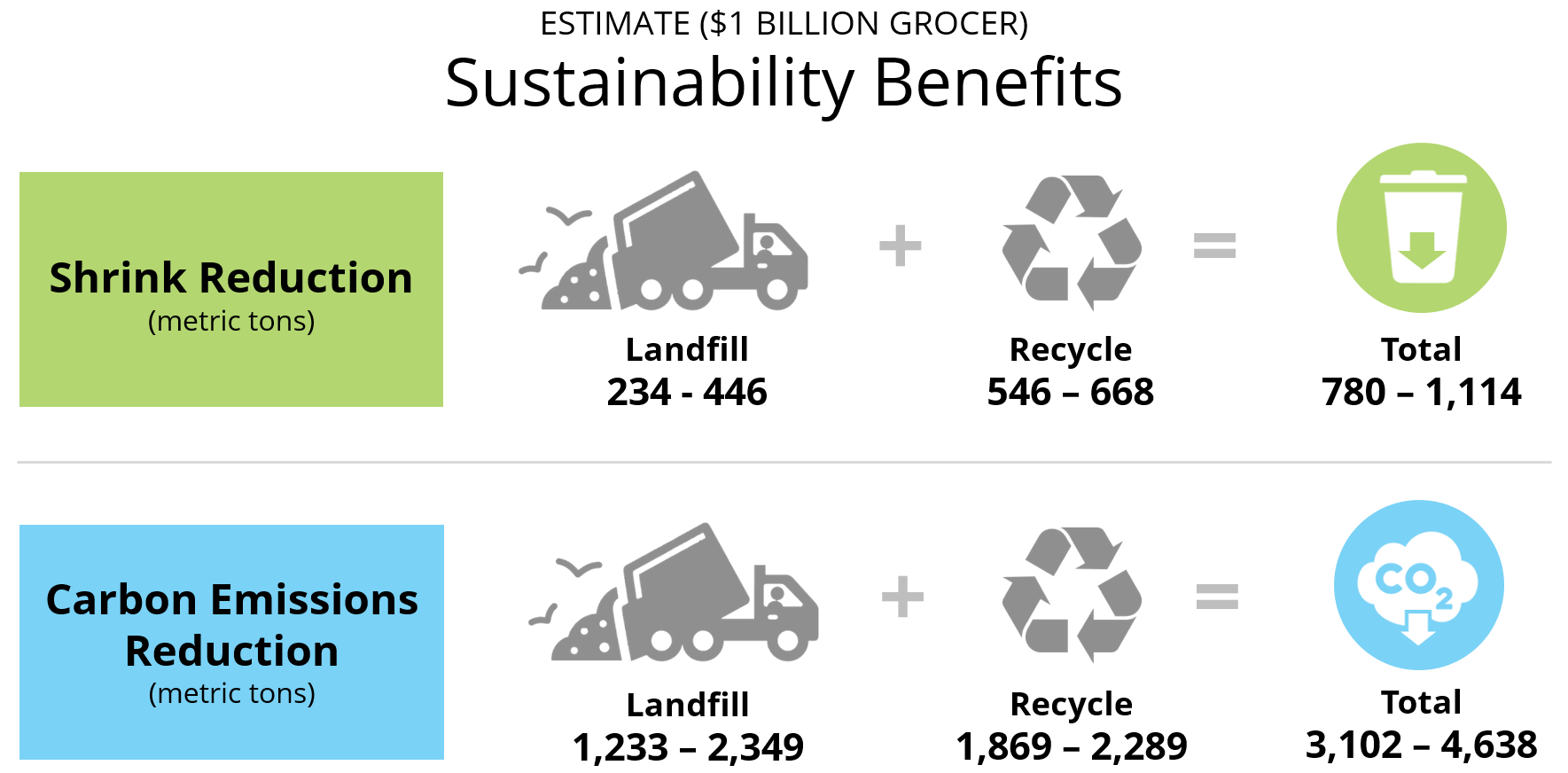

Planalytics works with leading retailers to improve demand forecasting with Weather-Driven Demand analytics. Enhancing store-level replenishment in produce, dairy, meat, seafood, and other fresh food departments offers the double benefit of optimizing inventories and increasing sustainability by reducing waste. Less perishable food waste also reduces the company’s carbon footprint.

Better demand forecasts are a great place to start for a grocer pursuing sustainability gains and, because the business is improving a core, everyday process, there are significant profit gains to be had. Planalytics’ experience with grocers shows that a business can reduce perishable waste by an average of 12%, which corresponds to more than a 4% in decreased carbon emissions. Learn more here.

5 expensive energy mistakes grocers are making

The next topic in the series focused on five energy inefficiencies that hurt grocers’ profits.

“Food retailers can save roughly $15,000 annually per store by improving five overlooked practices, according to Ratio Institute, a nonprofit specializing in grocery sustainability.”

Where can grocers look for gains? Improving appliance efficiencies, unblocking return air vents, reducing air infiltration, keeping walk-ins closed, and maintaining walk-in doors.

How a regional grocer balances sustainable efforts with its bottom line

In the final article, Grocery Dive highlights how Harmons Neighborhood Grocer made its green initiatives a priority for top management.

The interview with Harmons’ director of sustainability, Kate Whitbeck, “shared how she advances Harmons sustainable practices and balances those projects with consideration for the company’s bottom line.”

“I understand some individuals are obviously swayed by a financial argument more so than an environmental argument” said Whiteck. “So I try to spell out if there’s an ROI on a particular investment. Obviously, not everything we do related to sustainability can show a cost savings but, fortunately, with most interventions related to energy or waste, there are cost savings to be had.”

In one question, Grocery Dive asked Whitbeck about the typical timeframe for sustainability initiatives to begin generating a profit. “I don’t think there’s a typical number, it’s very specific to the initiative and to the location,” said Whitbeck. “I think it’s obviously anything that’s five years and under, it’s going to be an easier sell.”

In another question, the interviewer asks about carbon footprint calculations and measuring the performance of sustainability efforts. Whitbeck offers an example of waste diversion. “What percentage of the waste are they diverting from the landfill at each store? We’re looking at tonnage rates.”

Using Weather-Driven Demand (WDD) metrics in demand forecasting and replenishment helps grocers balance on-shelf availability and limiting waste in perishable categories. Moreover, sustainability gains and profit gains can be measured in this inventory replenishment use case. “Five years and under” is a benchmark that is easily met as grocers typically begin seeing the financial return to the business within 90 days and a full ROI within 180 days. And as the graphic above illustrates, waste reduction is an area that allows a company to directly measure and report sustainability gains.

For more information, check out this article posted by Planalytics’ partner SAP or download our Leveraging Demand Analytics to Reach Sustainability Goals white paper.