Weather-driven retail “egg-spectations” for Easter 2024

March 20, 2024

With Easter falling in March (3/31) for the first time in eight years, retailers may be worried that key spring category sales will lag behind last year’s run-up to Easter. Any sales performance concerns certainly have merit since the average temperature is about 3 degrees cooler in the last week of March than the second …

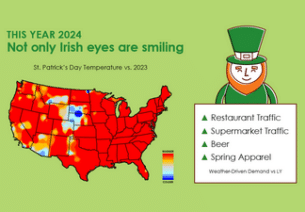

St. Patrick’s Day Retail Weather Impact

March 11, 2024

The “Luck of the Irish” will be with stores, restaurants, and bars in 2024 as warmer temperatures vs. last year throughout most of the country will boost traffic and sales. More springlike temperatures this year will provide a boost for retail with only a “wee bit” of rain in the eastern half of the country …

Seize spring sales opportunities NEXT WEEK before demand pulls back in late March

March 8, 2024

As we approach the official start of the spring season, brace for a wild ride of fluctuating temperatures and demand volatility across the U.S. through the end of March. Next week, many areas are expected to warm up considerably, providing an excellent opportunity to capitalize on increased traffic and promote and sell spring-season products. However, the …

Holiday Homestretch: The Weather Gives Store Traffic a Boost

December 19, 2023

Retailers are in the final stretch of the 2023 holiday shopping season with the week closing on December 23rd – Super Saturday – when an estimated 142 million shoppers are expected to hit the stores according to the National Retail Federation. Super Saturday is typically one of the largest volume shopping days of the year, …

Record-Breaking Black Friday Weekend Shopping

November 30, 2023

CNBC reports that a survey conducted by the National Retail Federation states that a record number of shoppers, both in-store and online, kicked off the holiday season. Total spending on holiday-related purchases was not estimated; however, the $321.41 average was roughly in-line with the $325.44 average last year. NRF CEO Matt Shay explained that in addition …

The Coldest Black Friday Weekend in 10 Years Had Consumers Gobbling Up Seasonal Categories

November 27, 2023

Driest Holiday Weekend Since 2017 Supported Foot Traffic into Shopping Destinations The Thanksgiving and Black Friday weekend (November 23 – November 26) was the coldest since 2013 and driest since 2017, helping to kickstart the holiday shopping season with strong seasonal demand. On the heels of a mild week across the U.S., and a very …

Get ready to turn up the excitement dial this Black Friday Weekend!

November 17, 2023

It’s not just a chill in the air; it’s the perfect storm for demand spikes for seasonal categories from winter apparel & accessories to warming foods and beverages. The holiday week will feature a wave of cold temperatures sweeping eastward, pushing markets from the Plains to the East Coast with a trend below normal …

NRF Discusses Holiday Retail Sales Outlook

November 10, 2023

On November 6th, the National Retail Federation (NRF) held a webinar focused on retail sales expectations during the 2023 holiday shopping season. NRF Chief Economist Jack Kleinhenz and Vice President, Industry and Consumer Insights Katherine Cullen hosted the presentation (view the webinar recording) which discusses the NRF’s 2023 holiday sales forecast, economic considerations, and consumer …

Sustainability can benefit the bottom line.

November 9, 2023

An article on Supermarket Perimeter summarized a report on sustainability from the consultancy group Alvarez and Marsal. Their report – “The Grocer’s Sustainability Playbook: How sustainability can boost your bottom line” – looks into the role AI and supply chain solutions can help businesses achieve sustainability goals. “Does sustainability need to come at the expense of profits,” …

Restaurant Sales Volatility Increases in Winter Months

October 31, 2023

As we flip our calendars to November and Mother Nature begins to flip the weather script, it is a good reminder for quick service, fast casual, and other restaurant chains that the conditions outside will begin to have a greater effect on consumers and therefore, traffic trends and sales. Weather Sensitivity, a metric Planalytics calculates …